It is time for CX leaders to get serious about quantifying the business value of customer experience. A great place to start is with the metrics you are already tracking. This article will explain how to utilize headline customer experience metrics, such as NPS, CSAT and CES to calculate CX ROI.

CX leaders are under increasing pressure to demonstrate how customer experience management positively impacts the bottom line. Forrester Research recently reported that a mere 15% of global CX leaders are effective at proving the business impact of CX. The majority, 58% said they were not effective at this. Based on my engagement with client and CX practitioner colleagues around the world, I can say with confidence that this topic has never been more important, though it remains challenging.

Fortunately, there are MANY ways to calculate the ROI of customer experience. A logical place to start is with the most popular CX metrics such as Net Promoter Score (NPS), Customer Satisfaction (CSAT) and Customer Effort Score (CES). Not only are these metrics often already well-socialized with executives, many organizations also track these on an ongoing basis, meaning that the data is readily available.

Happy customers are good for business

The logic behind this CX ROI approach is as follows: as an organization becomes more customer-centric and provides better experiences for customers, CX metrics should improve in tandem with the business performance metrics associated with the behavior of happier, more loyal customers. E.g. repeat purchases, larger spend, and longer retention. The business performance measures can vary somewhat by industry, but there are well documented correlations between customer satisfaction and higher rates of repurchase, larger basket size, lower levels of churn, etc. As CX metrics rise, so should the corresponding business performance indicators.

The key to this type of CX ROI calculation is to identify a business performance metric or two (and preferably at least one with a financial value) with a strong correlation to a CX metric. Once that has been established, you can track the rise of your CX metric and then extrapolate the financial impact, essentially quantifying the high-level ROI of your organization’s CX efforts.

The CX ROI calculation

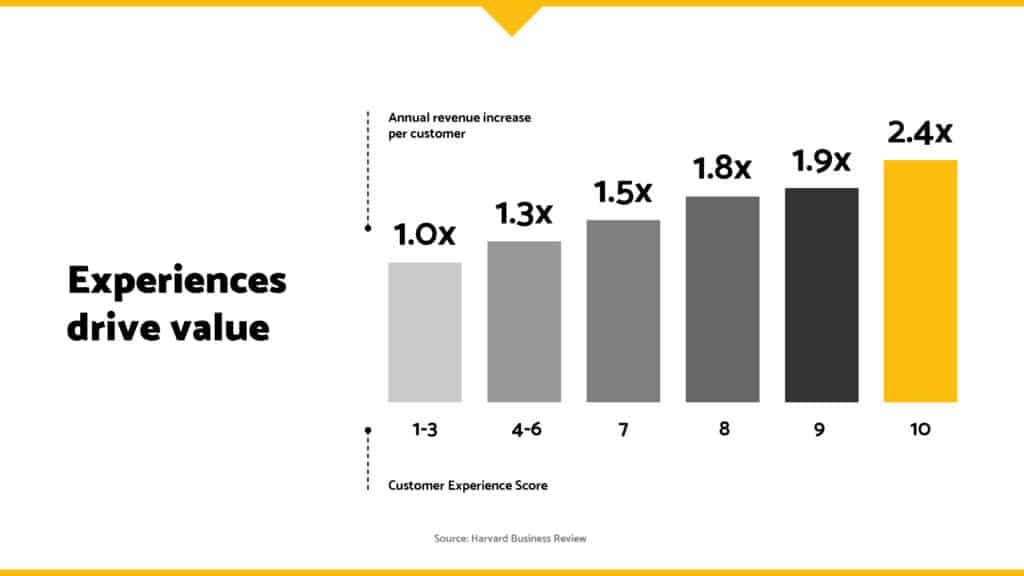

For example, let’s say that a team has identified a strong correlation between customer satisfaction and annual customer spend. (We’ll use an actual correlation value published in the Harvard Business Review for this example.)

If the average customer satisfaction were to improve from a dismal 3 to a much more acceptable score of 7 during the course of a year, the organization could expect to see the average customer spend increase to 1.5X the previous average (in other words an average 50% increase in customer spend). If average annual customer spend had been $1000 in the baseline year, this would theoretically increase to $1500 per customer after the improvement in satisfaction. As a final, step multiply both numbers by the size of the customer base in both periods to quantify the impact.

($1500 X 21K customers) – ($1000 X 20K customers) = $11.5M

You’ll note that the customer base also grew between the two periods. Customer retention might be an additional benefit of better customer experience management, and this would be captured when we calculate CX ROI.

Using an established relationship between customer satisfaction and average spend, we can estimate that the CX efforts which resulted in a 4-point lift in customer satisfaction, catalyzed a $11.5 million annual increase in customer spend. If actual total customer spend increased by $13 million during the period, that’s fine. We can attribute some of the increase to the team’s CX efforts and some to other factors (new products, better market conditions, promotions, etc.).

Challenges and considerations

In fact, this is one of the challenges of linking headline CX metrics to business results. It doesn’t take long for leaders to realize that a LOT of factors influence things like NPS scores or how much customers spend in a year. It’s difficult to get granular with this top-down CX ROI approach.

Keep in mind that nearly all of these high level CX and financial metrics are also lagging indicators, that move slowly, so it can take time to see the impact of CX efforts on things like loyalty. It can even be counterproductive to monitor these metrics too frequently, as micro fluctuations from week-to-week or month-to-month can make it difficult to interpret the meaningful trends. I suggest using this method to track aggregate CX change and impact over time, ideally quarterly. I’d recommend pairing it with a bottom-up approach like ROX to demonstrate “quick win” impact at a granular level.

Find the right financial metric

Keep in mind that this approach relies on finding an appropriate financial metric with a strong relationship to a CX metric, so that you can extrapolate the business impact as CX (hopefully) improves. The equation is not going to be the same in every instance. Here are some business performance metrics to consider:

- Churn – opportunity cost of their lost business

- Retention – improved customer lifetime value

- Repeat purchases – increased average revenue per customer and savings in cost of acquisition

- Purchase volume or frequency – increased average revenue per customer

- Size of the customer base – increased revenue from a larger pool of customers

Set-it-and-forget-it

I liken this approach to the “slow cooker” of CX ROI methodologies. It requires some forethought and research. Expect a bit of legwork gathering the right data and testing your correlations, and be sure to manage leadership expectations around timelines to see results. That said, once you’ve set up your calculations and tracking method, you can leave this methodology to do its thing, checking back in periodically to refresh your correlations and review results.

If you have questions or need assistance getting your CX ROI competency up and running, I’d be happy to help. Please don’t hesitate to get in touch.

Julia Ahlfeldt is a customer experience strategist, speaker and business advisor. She is a Certified Customer Experience Professional and one of the top experts in customer experience management. To find out more about how Julia can help your business achieve its CX goals, check out her customer experience consulting services (including journey mapping, CX strategy development, experience innovation, leadership workshops and CX ROI measurement) or get in contact via email.